The auto parts market in Mexico has seen tremendous growth over the past five years, redefining how the automotive industry operates and how value in the space is created. A McKinsey report highlights that the online automotive market e to reach $1.4 billion by 2030, with an annual growth rate of 3%.

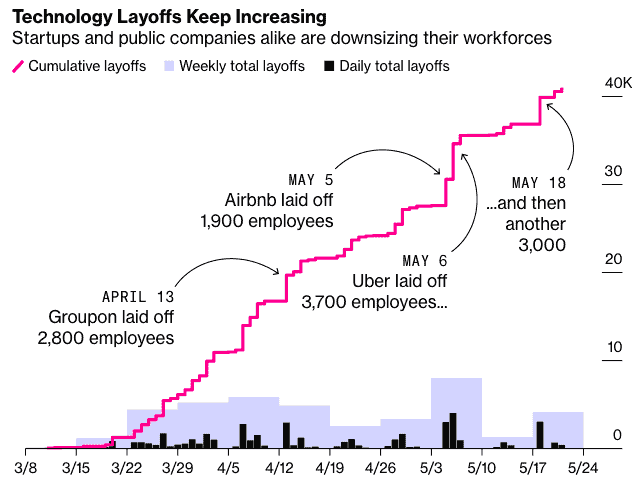

Fueled by brick-and-mortar players entering the online space, this growth is estimated to continue rising as more consumers shift towards online shopping at the onset of COVID-19.

Residing in Guadalajara, “the Silicon Valley of Mexico”, RIGS is a D2C tech startup that connects auto parts, buyers, with retailers under one platform.

RIGS is on a mission to provide direct access to top-notch auto parts for customers in Latin America. CEO of RIGS, Nestor de Haro, tells us the company’s story, how he established an e-commerce platform and the current challenges in the aftermarket industry in Latin America.

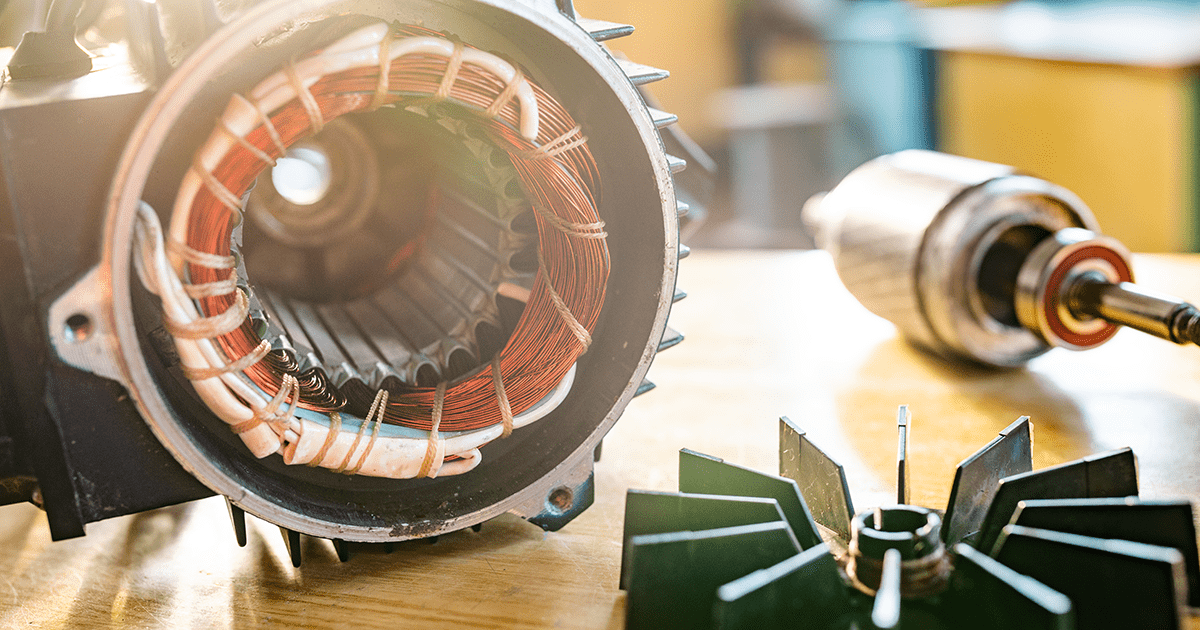

Digitising the auto parts marketplace

Nestor’s entrepreneurial journey began eight years ago. With a B.S. of Industrial Engineering from Tecnologico de Monterrey under his belt, he started building his first startup, RIGS. At the time, RIGS’ initial product was a search engine technology built to help customers search and find auto parts online in a fast and easy way.

“The technology that we built enabled many customers to easily find and search for auto parts. That’s when we knew that the future was going to be e-commerce and commercializing every single product online,” Nestor said.

Nestor saw a promising opportunity for digitizing the automotive market. Combining the technology he built with his passion for automotive, RIGS evolved into an e-commerce platform that provides thousands of world-class and affordable auto parts from multiple brands, which can be delivered in a few days anywhere in Mexico.

The startup encourages car owners to buy the auto parts and fix their own cars, saving costs of spending repairs at mechanic shops.

“If you go directly to the mechanic and want to change something in your car, he will charge you for both the car parts and the labour. And even though most of the parts you buy at the mechanic are not good quality, they still charge you a high price,” Nestor said, adding that more customers now prefer buying their own auto parts to only get charged for the cost of labour.

Mexico is the 5th largest auto parts producer worldwide, with $92 billion annual revenues and one of the biggest vehicle manufacturers in the world. The aftermarket industry in Mexico has several active players. One of them is OEMs, original equipment manufacturers, which sell auto parts for global vehicle brands like BMW, Chevrolet, Nissan and Toyota and whose main profit comes from providing expensive car repair services. Other players include the sellers who import cheaper auto parts from China and distribute them locally to make some profits.

According to Nestor, the scarcity of high-quality and well-priced auto parts is one of the main challenges in Mexico’s aftermarket industry.

“If you live in Veracruz, most of the retailers near you will only commercialise the auto parts that your mechanic would buy because they are cheap. If you want to obtain good quality and better products, it’s not that easy to find in your local region,” explained Nestor.

RIGS’ platform provides over 2 million auto parts from retailers in Mexico and the U.S. to customers in different parts of Mexico, including Monterrey, Guadalajara, Mexico City and more. The startup’s proprietary technology simplifies the process of searching and buying parts from multiple wholesalers in the same place.

Challenges in the online aftermarket industry

Like many e-commerce platforms, the process of building consumer trust takes time.

“Online shoppers always fear being exposed to fraud or encountering problems with the product. Some customers want our physical presence in their state or city because it makes them feel more secure using our services. But it’s not always easy for us to create multiple physical locations.”

There are several other challenges in the industry. One of them is the lack of information provided by sellers about the car parts they display for sale. Many customers have no experience buying parts for their car and cannot identify what they need.

To overcome those issues, RIGS developed a simple, easy-to-use search engine technology where customers can provide information about their cars, including the model. The year it was released, the engine type, so that they receive suggestions for the car parts that best suit their needs.

“We are simplifying the purchasing process for customers who don’t have the technical know-how when it comes to their cars. This technology is what sets us apart from the rest of the auto parts sellers in the industry,” Nestor said.

Tribal Credit powers RIGS to make cross-border payments

On its journey of growth in LATAM, RIGS chose Tribal to help with their international payments.

Like many founders in Mexico, Nestor encountered difficulties opening a business bank account and challenges navigating cross-border payments. According to Nestor, Mexican banks assume their customers only make transactions with local companies.

“Most of the tools we use to improve our business are based in the US and other parts of the world. But banks constantly decline the transactions because their algorithm cannot identify that this specific company is transacting with companies from different parts of the world,” explained Nestor, adding that declined transactions cause financial losses and cut into his startup’s budget.

Another challenge is the fixed transaction times imposed by banks, where transactions can only be made between 9 am and 7 pm Monday to Friday. Transactions outside those time frames will get declined.

“Even if you have to make big payments, you’re only allowed to make them between those time frames. It’s ridiculous. Both your company and card need to be available 24/7. Banks in Mexico are not considerate to startup founders who are working locally but transacting globally.”

Empowering RIGS to gain better access to financial services, Tribal facilitates smooth online payments including cross-border transactions around the world so that founders are never held back by declined transactions.

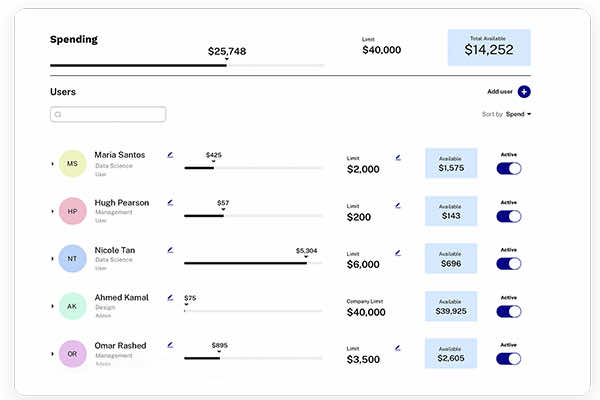

“With Tribal, it’s different. We can buy it anytime we want. We have a specific credit balance and we always know how much money is left. The most important thing for me as well is that we pay once a month,” Nestor said.

Tribal helps RIGS overcome issues like high currency exchange rates imposed by Mexican banks.

Banks in Mexico decline increasing credit line requests made by startups, even when they have money in the bank. Tribal enables startups like RIGS to request a higher credit line whenever needed, saving the startup valuable time going to the bank and filling lots of paperwork and awaiting approval.

“It’s very complicated for a startup in Mexico to make global transactions. Banks in Mexico are not prepared for the globalized market. It’s great when international companies like Tribal trust in our company.”